Welcome back to our latest Weekly Rand Review!

In a subdued week of economic activity both domestically and abroad, the South African Rand found itself navigating the currency markets with a watchful eye on global events.

One significant influence on the Rand's performance was the surge in US Treasury yields, a trend that has gained momentum in recent times. Producer price inflation figures were the main talking point locally, especially as we edge closer to the crucial midterm budget results this week.

Despite the thin economic calendar, there were still a few occurrences that left their mark on the Rand's valuation against the greenback…

...and much like the Boks against England, just when it looked likely it was staring a losing week in the face, a late second half surge resulted in it coming out tops in the end!

Let’s get into the details!

Key Moments (23-27 October 2023)

These were some of the major headlines over the last five days:

- Local PPI - During the week, Stats SA released results indicating an increase in the headline PPI in September from a month earlier.

- US GDP - The US economy experienced robust growth in the three months ending in September, more than doubling the growth rate of the previous quarter.

After a solid comeback in the closing hours of trade the previous week, the Rand weakened on Monday morning, opening a shade above R19/$. With very little domestic data expected in the week, the local currency was poised to take its directions from powers abroad…

…and that became evident early in the week, with the local unit falling to R19.14/$ by lunchtime.

One of the main reasons for the pain felt by emerging markets investors has been the recent spike in US Treasury yields. The yield on the US ten-year benchmark treasury bond has surpassed 5.0% for the first time in over 15 years this month.

This increase is driven in part by expectations of heightened US borrowings and the anticipation that short-term interest rates will remain elevated for an extended period.

In addition, the recent downturn in the Chinese economy has had adverse effects on investor sentiment toward South Africa...

...not unexpected with SA being a major commodity exporter with China.

With no major data releases in the first half of the week, let’s take a moment to catch up on some of the other noteworthy happenings you may have missed:

Starting with a bit of good news…

…Saffers can look forward to some relief at the pumps in the upcoming weeks, as a combination of a lower oil price and a 'relatively stable' Rand is poised to result in substantial price reductions. The expected decrease is approximately R2.00 per litre for petrol and R1.00 per litre for diesel.

The reduction in prices can be attributed almost entirely to the decline in international product prices, reversing the highs observed at the end of September that prompted the steep price increase in October.

Oil prices surged two weeks ago amid the outbreak of conflict between Hamas and Israel in the Middle East…

…with the primary concern around the potential spread of the conflict to other nations, prompting apprehensions about future oil prices. Although these concerns still persist in the market, oil prices retreated last week, also influenced to some extent by a stronger dollar.

Next - The social relief grant introduced in 2020 in South Africa to assist those most severely impacted by the pandemic is expected to be extended beyond March next year…

…however, there is still uncertainty (as there well may be!) around how this will be funded, especially considering the recent concerns regarding the state of the government’s finances and budget gaps.

Transnet, the state-owned logistics company, has announced its request for an undisclosed cash injection from the government…

…claiming that this initiative is part of its efforts to decrease debt and restore profitability.

Yeah, sure it is...how about cutting overheads instead?

As we headed into the back nine of the week, the Rand was still trading above the psychological R19/$ mark, reaching its highest point over the five-day cycle at R19.27/$ on Thursday morning - and staring another dismal week in the face...

Results from Stats SA showed that the headline Producer Price Index (PPI) for September rose from 4.3% in August to 5.1% in September.

The major culprits behind the increase were food products, beverages, and tobacco products, which increased by 4.4% year-on-year and contributed 1.1 percentage points.

Concerningly, several potential risks still loom...

...including challenges associated with the Black Sea Grain Deal, India's ban on rice exports, the avian flu outbreak, and increased weather disturbances, particularly from El Niño.

This comes as SA is bracing for what could be a challenging mid-term budget policy statement this week, owing to a macroeconomic landscape that has worsened since the release of the main budget in February.

In particular, inflation has shown a slower decline, interest rates have risen more than anticipated, and GDP growth is slower than initially projected. In September, inflation rose to 5.4% due to higher fuel prices, and most market participants are expecting the 2023 average to be around 5.9% - 6.0%.

All the while, the US, and in particular, the greenback, continues to reign supreme.

Inflation in the US accelerated, but consumer spending was even stronger than expected, according to a report from the Commerce Department.

The core personal consumption expenditures price index, a key measure of inflation used by the Federal Reserve, increased by 0.3% for the month. Then, a blockbuster jobs report released earlier this month exceeded economist expectations by nearly twofold. And last week, the latest data revealed that US GDP expanded at an annualized rate of 4.9% during the three-month period ending in September…

…marking an notable acceleration from the 2.1% observed in the previous quarter.

However, the recent surge in government bond yields has resulted in higher borrowing costs for consumers seeking mortgage loans and corporations looking to secure funds for business expansion.

With all this good news out the US, one would have thought it would have caused the Rand to weaken further...

...but that is not how markets work, and instead the Rand strengthened late on Thursday, back into the R18.90s and was on course for more gains.

Then in other news:

- The European Central Bank's governing council, at its meeting in Athens last week, decided to keep its benchmark interest rates unchanged. The deposit rate, paid on commercial bank deposits, remains at 4%, remaining at the highest level since the inception of the euro in 1999. The main refinancing operations rate, determining weekly borrowing costs for commercial banks, and the marginal lending facility rate, providing overnight credit to banks, were also held steady at 4.5% and 4.75%, respectively. This decision puts a pause, at least for the moment, on a series of ten consecutive interest rate hikes.

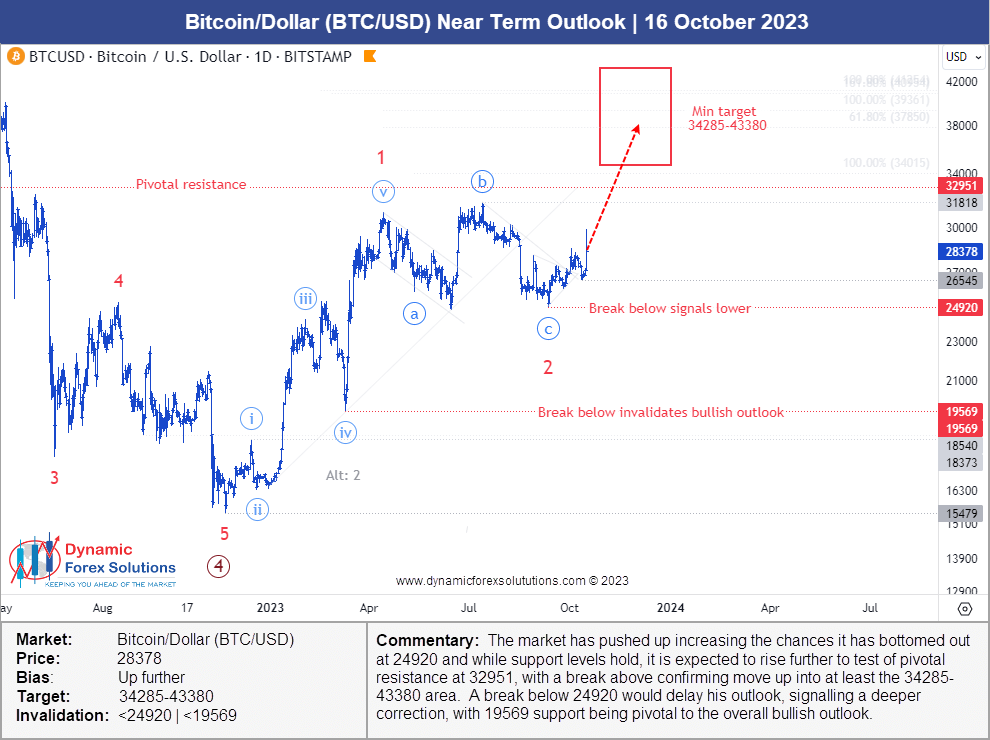

- Bitcoin had a great week, surpassing $35,000 for the first time since May 2022 and experiencing a 20% increase over the past 10 days. The highly volatile cryptocurrency has more than doubled in value this year, largely driven by investor enthusiasm for the prospect of purchasing bitcoin funds on traditional stock exchanges, avoiding less-regulated and sometimes dubious crypto platforms. The recent excitement in the industry has been around the inclusion of the BlackRock exchange-traded fund for Bitcoin on a list managed by the Depository Trust and Clearing Corp., a Nasdaq-operated clearinghouse for stocks and ETFs.

This took many by surprise, but our near-term Bitcoin forecast issued 2 weeks ago anticipated this move higher to a tee, as you can see below.

- SA: Balance of Trade (Sep), GDP MoM (Aug), Medium Term Budget Policy Statement (MTBPS)

- EU/UK: BOE Interest Rate Decision

- US: CB Consumer Confidence (Oct), ISM Manufacturing PMI (Oct), Fed Interest Rate Decision, Non-Farm Payrolls and Unemployment Rate (Oct)

(Click to enlarge)

Click here to find out more about our global forecasts

After a week that until Thursday looked like it was losing he game, the local unit continued to strength in early trade on Friday as investors awaited the mid-term budget next week…

…which is expected to offer further insights into the state of the economy.

The Rand opened trade at R18.92.$ and improved to R18.77/$ in the afternoon before seeing out the week at R18.80/$.

A pretty decent turn-around, all things considered!

The Week Ahead (30 Oct - 3 Nov 2023)

Here's what we'll be eyeing up over the next five days:

And just like that M1 of Q3 has come and gone.

Next week is a big one, full of crucial data results that are likely to pave a pathway for the Rand, and hopefully result in positive returns for its backers.

Our forecast system is throwing up a few interesting patterns over the next few weeks, so don’t forget to subscribe if you have not already done so.

See you next week!

Please take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now. No charge. No card. All yours to trial for 14 days.

(You don't want to regret not having done so this time next week...)

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Review in your inbox every Monday