Greetings, currency enthusiasts!

Well, here we are, already well into October...and there has been no let-up of action.

In a week where currencies faced challenges on a global scale, the Rand's trajectory reflected a delicate interplay of economic dynamics.

With significant shifts in global financial markets, the local unit experienced a notable turn for the worse, reaching its weakest levels since the Lady R saga earlier this year.

The reverberations of these losses, however, were not confined to regional boundaries but extended to impact emerging markets on a global scale. As fears of a slowdown in economic growth and uncertainties surrounding global trade dynamics intensified, investors sought refuge in traditional safe-haven assets, placing increased pressure on emerging market currencies, including the Rand.

Closer to home, local factors have further exacerbated the Rand's decline, albeit to a lesser extent compared to the global headwinds.

Possible R20/$ whispers are getting louder - let's get into the details and unravel the story behind the numbers...

...and also show you how we had this past week's movement nailed.

Key Moments (2-6 October 2023)

These were some of the major headlines over the last five days:

- Dollar Dominance -This week was all about the strength of the US Dollar, with domestic factors playing second fiddle with regard to the Rand's performance.

- ABSA Manufacturing PMI - A sharp drop in this index underscored the multiple challenges being faced by local manufacturers.

- US Non-Farm Payrolls - Always a biggie in terms of a market mover, US non-farm payrolls didn't disappoint, sparking some significant moves.

Despite a thin week of data results, the last five days were a perfect example of the intricate dance of global and domestic forces that have shaped the South African Rand's journey in recent times. After several weeks of trading in a narrowing range, the local currency seemed to be finding some stability at the lower end of the range - albeit it at a level uncomfortably high for importers and consumers.

But if anyone thought that this was the new normal, they were in for a surprise...

...as our forecast from the previous Friday clearly showed (see chart below).

With the market sitting a 18.91 late on Friday, our forecast modelling was indicating that the Rand was likely to weaken sharply - breaking out of the 6-week long consolidation, and pushing up into the 19.40-19.75 area.

If this played out, it was going to be a week where many would be caught napping...

(Click to enlarge)

And it didn't take long for things to start happening...

The local unit began the week just below the 19/$ but broke through the psychological barrier before lunch, setting the tone for the week to come.

Chief among the reasons for the local unit’s demise was the strength of the US dollar, with the Rand hitting its worst levels in months been emblematic of a broader trend sweeping throughout emerging currency markets.

While the global stage set the tone for much of the Rand's struggles, domestic factors, though comparatively less impactful, also contributed their share to the currency's woes. The Absa Purchasing Managers’ Index was a notable contributor, plummeting 4.1 points in September to 45.4, which was driven by escalating rolling blackouts, surging fuel prices, and weakened demand in the EU and UK.

In essence, the manufacturing sector is displaying pronounced signs of strain, posing challenges for job creation, export earnings, investment, and the overall economic landscape.

On the back of this, the local unit dropped further, ending the day at R19.18/$.

And unfortunately, it didn’t get much better overnight, as the Rand was within touching distance of R19.30/$ by Tuesday morning.

With little on the agenda for the day, the Rand traded sideways, ending about level from where it started. On Wednesday, the Department of Energy and Mineral Resources revealed that both petrol and diesel prices are poised for yet another significant surge in October 2023…

…following the harsh fuel price increases witnessed in September.

As per the official statement from the department, the adjustments entail a notable rise in petrol prices, ranging between R1.08 and R1.14 (with diesel prices expected to increase between R1.93 and R1.96.

...and the Rand suffered as a result, as the midweek saw it at its worst levels against the Dollar since early June, trading at R19.35 for a single greenback. But the pressures on the Rand were more about a strong Dollar, underlined by the upward trajectory of US bond yields...

…a trend that gained momentum following the Federal Reserve's indication of potential interest rate hikes in their recent meeting.

Concurrently, mounting recession fears in the European Union have added to the allure of the US dollar as a safe-haven currency.

Some are now arguing that the prevailing "higher for longer narrative" suggests that the US dollar might maintain its strength for an extended duration beyond previous expectations.

The appreciation of the Dollar is being attributed to the US economy being seen by many as standing prominently above others in terms of apparent robust data and resilience in the face of a potentially higher interest rate environment.

Though this in itself is open to debate - with a number of grey areas that in-tune observers may well question.

Yet still, perception is a key driver of sentiment, and based on the current state of play, the US dollar seems to be leveraging its strengths quite well. Ultimately, a prolonged strength of the Dollar would pose a significant concern for the Rand, which mainstream economists seem to be suggesting is inevitable...

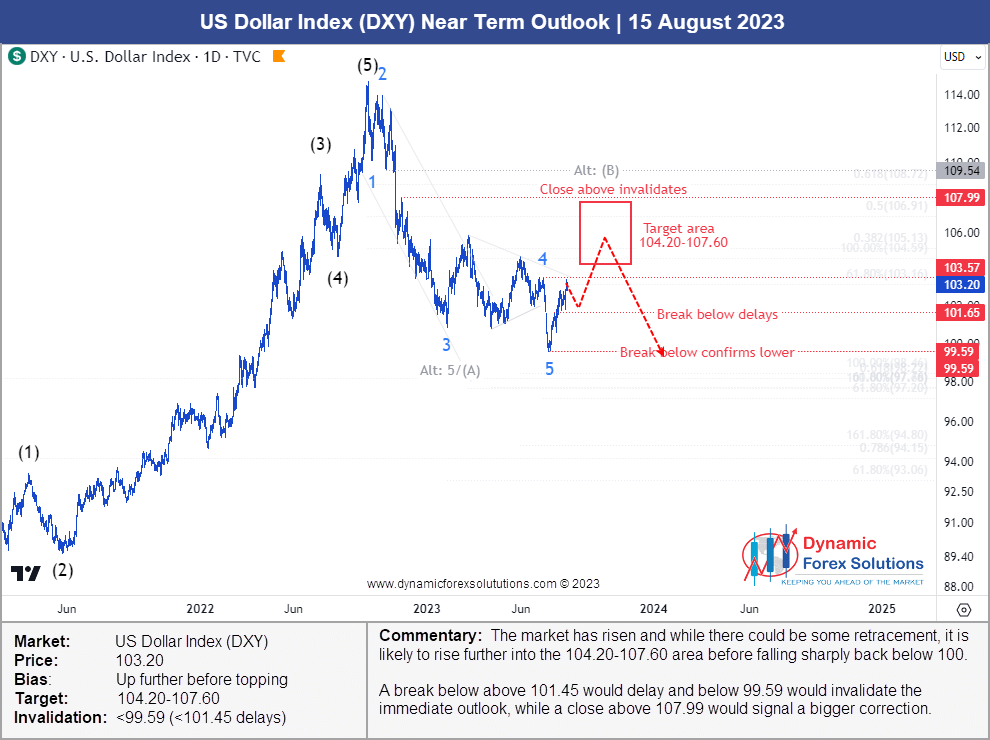

...but our own analysis of the Dollar Index back in August is suggesting otherwise - that the multi-month move is merely a countertrend move, expected to extend up into the 104.20-107.60 area before reversing sharply (see chart below)

(Click to enlarge)

As Thursday arrived, the Dollar flexed its strength again as speculation grew that the Fed may once again need to hike interest and possibly keep them elevated for a sustained period.

As a result, the local unit hit R19.64/$ - its worst level since May when the rift ensued between the US and SA over the docking of the sanctioned Russian vessel, Lady R, in Simon’s Town. For Saffers, the spotlight is now on Finance Minister Enoch Godongwana and the approach he takes with the Medium-Term Budget Policy Statement in November.

Any strategy reliant on wishful thinking about a resurgence of economic growth or attempting to spend our way out of trouble with additional debt will likely receive a strongly negative reaction…

…but with how our country's finances are managed, it also wouldn’t be a total shock.

Another local factor weighing on the Rand is recent government finance figures that indicate significant overspending and a shortfall in revenue compared to the same period a year ago…

…which understandably raises concerns about the potential for even further credit downgrades by credit agencies, all while the country continues to grapple with persistently low economic growth. Needless to say, a weakened Rand could contribute to higher inflation, especially given the current elevated oil prices impacting the costs of petrol and diesel.

The possible outcome?

Unfortunately, the combination of high inflation, elevated interest rates, sluggish economic growth, and low confidence may prompt local investors to move their money abroad (in larger quantities than at present)…

…which will add further pressure on the exchange rate.

One really has to feel for SARB boss Lesetja Kganyago, who is being backed into a corner, leaving him with little option but to raise rates in an effort to counter the attractiveness of the Dollar.

And with that, the Rand ended Thursday at R19.50/$!

Then in other news:

- In September, the U.S. services sector exhibited a slowdown, marked by a dip in the ISM non-manufacturing Purchasing Managers' Index (PMI) to 53.6 from 54.5 in August. Although this decline suggests a moderation in the pace of growth, the reading above 50 still signifies expansion in the services industry. Notably, the dip in the services PMI is accompanied by a nine-month low in new orders, indicating a shift in consumer spending away from goods, influenced in part by higher interest rates.

In contrast, the manufacturing sector reported a contraction in its PMI for September, marking the 11th consecutive month of decline. However, the pace of this contraction notably decelerated, as highlighted by the ISM's report on Monday. These contrasting trends across sectors depict a nuanced economic landscape, where the resilience of the services sector helps uphold expectations for solid overall economic performance in the third quarter.

- The crisis surrounding China's second-largest property development firm, Evergrande, has evolved from a financial quagmire to a potentially criminal affair with the recent investigation and detention of Evergrande's chairman and founder, Hui Ka Yan. Following a brief suspension last week prompted by media reports of Hui's apprehension, Evergrande resumed trading on Tuesday.

However, there are ominous indicators that point toward a potential liquidation of the company. Such an outcome could have far-reaching implications not only for Evergrande but also for the broader Chinese economy.

While the Chinese government's actions concerning Evergrande were seemingly intended to stabilize the real estate market, the arrest of Hui is anticipated to exacerbate the situation. The regulatory measures implemented in 2020 have already led to defaults by companies responsible for approximately 40% of Chinese home sales.

On Friday morning, the Rand, like most currencies, gained on the greenback ahead of the crucial Non-farm Payroll data release.

By midday, the Rand had pulled its way back to the mid-R19.30s, but it was just a slight calm before one more storm for the week.

And when the news hit, the US labour market had showcased remarkable resilience last month, with the addition of 336,000 jobs, surpassing expectations and seemingly underscoring the strength of the world's largest economy.

Moreover, positive revisions were also made to the July and August readings, now reflecting the addition of 236,000 and 227,000 jobs, respectively. The Unemployment Rate maintained its stability at 3.8%, and the Labor Force Participation rate remained unchanged at 62.8%

But this again raises the question -

Second or third jobs, perhaps (by force of circumstances to overcome the increased cost of living due to inflation)?

Regardless, in response to the robust employment figures, the Dollar made a late-week surge against its counterparts, and the Rand was certainly not spared. In the blink of an eye following the report, the local unit shot to the mid-R19.60s, but then pulled back to end the week above R19.30/$...

...and in so doing, validated the prior Fridays' forecast above to a tee!

(Were you caught out? I trust not...)

The Week Ahead (9-13 October 2023)

Here's what we'll be eyeing up over the next five days:

- SA: Mining Production YoY (Aug), Manufacturing Production YoY (Aug)

- EU/UK: UK GDP YoY (Aug), UK Balance of Trade (Aug)

- US: PPI MoM (Sep), FOMC Minutes, Inflation Rate YoY (Sep)

Fair to say, Q4 has started terribly for the local unit, and with the all-important US inflation rate results due in the week, we could see more major movements.

While the Rand looks poised for a torrid time, our forecasting models have continued to keep us one step ahead, enabling us and our clients to make the right decisions - at the right time...

...with the potential saving of up to 70c per Dollar in just a few days.

Please take our Rand forecasting service for a test-drive!

This will give you access to the same charts we are to give us and our clients the likely direction of the Rand - ahead of time, enabling you to make educated and informed decision.

Simply use the link below to get access now. No charge. No card. All yours to trial for 14 days.

(You don't want to regret not having done so this time next week...)

If you have any questions or feedback, please leave them below.

To your success~

James Paynter

P.S. Enjoyed this Weekly Rand Review? Click here to get our Weekly Rand Review in your inbox every Monday